Last Wednesday the US Federal Reserve raised the Fed funds rate for the third time since the 2008 financial crisis. Financial market commentators have worked hard over this eight-year period to create downside drama in the narrative of the return of interest rates from the abnormally low levels of 2008 towards more normal levels. But this latest move, like the two earlier moves, passed uneventfully. Success for a monetary policy-maker is when a change in policy is so well anticipated by financial markets that the action has no discernable effect: all impact has already been absorbed. By this criterion, US monetary policy is going brilliantly.

But never surprising financial markets with a rate increase creates a bias towards prevarication and delay. The Fed doesn’t expect rates to be back to ‘normal’ until 2019. President Trump’s arrival has buoyed business confidence and his foreshadowed tax cuts will take the budget in an expansionary direction. Given this new Trump world, does the gradualism that characterises the Fed Board under Janet Yellen risk putting the central bank ‘behind the curve’?

Caution has been the hallmark of the post-crisis Fed under both Janet Yellen and her predecessor Ben Bernanke. This is understandable and has worked out well. Not only was the economy seen (correctly) as experiencing a weak recovery, but the recovery was also seen as fragile. If a premature tightening of monetary policy clobbered this delicate recovery, there was little room for monetary policy to correct the mistake through lower interest rates (which were already effectively at zero). The risk of raising rates too quickly has been far greater than the risk of being a bit slow to act.

As well, financial markets were alarmist in warning about the impact of a Fed interest rate increase on emerging economies. The scenario painted was one where higher American rates would cause capital to flood out of these economies. Exchange rates would plunge and those who had borrowed dollars would be bankrupted, bring down economies. This scary scenario had been given some weight by the ‘taper tantrum’ of May 2013, when even the bare mention of the inevitable winding back of quantitative easing (QE) had sent a shiver through financial markets in emerging economies.

But the US economy is now growing at what many assess to be its long-term potential rate – just over 2%. Unemployment is 4.7%, a bit below what many would consider to be ‘full employment’. Inflation is creeping up towards the 2% target, with the core rate at 1¾%. Yellen describes the new setting as ‘accommodative’. Isn’t it about time to get rates on a faster track back to normal?

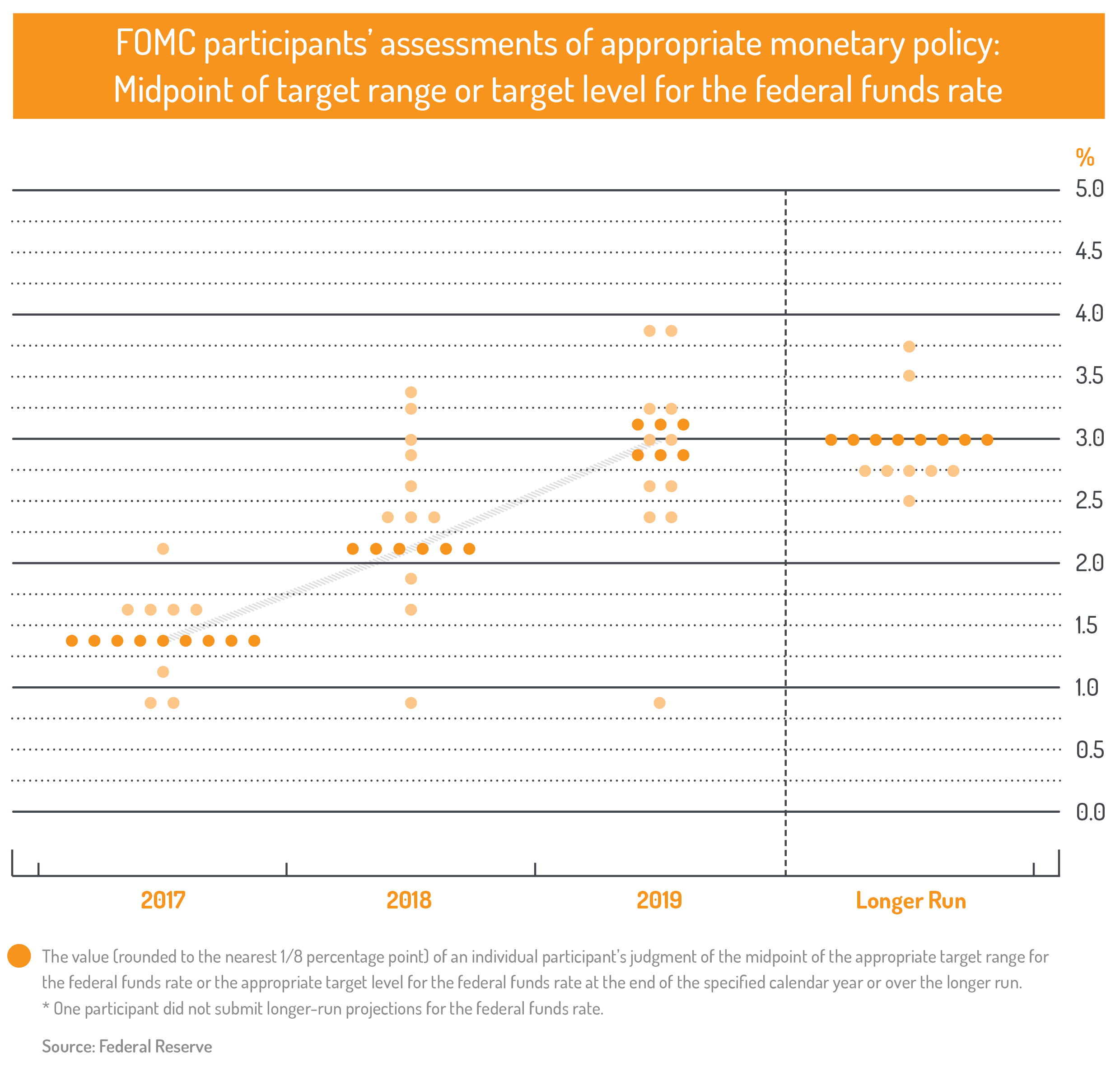

The decision on 15 March to move up by 25 basis points to 1% seems sensible. Any concerns focus on the projected path for further increases. The Fed board envisages two more 25 basis point increases this year (taking the Fed funds rate to 1.5%). Rates would be a bit over 2% by the end of 2018. On this leisurely schedule, by the end of 2019 the Fed funds rate will be back to the 3% historic norm. Here is the now-celebrated (at least in financial markets) ‘dot chart’ showing where individual Fed board members think rates should/will be in the future.

Yellen’s favourite word in describing this process of raising rates is ‘gradual’. So far the actual increases have been even slower than envisaged – most obviously when at the end of 2015 the Fed anticipated that there would be four increases in 2016, only one of which eventuated.

Even the latest decision had one dissenter who voted to leave rates unchanged. Neel Kashkari argued that inflation is still below target and that the target is in any case an average over time, so having been below almost constantly since 2008, there is no reason to fear an overshoot. Global inflation is still low. While unemployment is already below the level many would regard as ‘full employment’, the ‘U6’ measure (which supplements the unemployment figure by adding in those in part-time employment but seeking longer hours) is still above the pre-crisis level. As well, some workers who dropped out of the labour force during the recession might rejoin.

None of Yellen’s board colleagues seems to be concerned by asset prices -the ebullient stock market and strong housing indicators. Nor do they want to anticipate any budget stimulus President Trump might provide through tax cuts or infrastructure spending. What surety is there that this board is not made up of congenital doves who will let inflation get out of hand? The age-old problem for monetary policy is that interest rate increases are never popular. Shouldn’t the Fed be preparing markets for a faster pace of increase?

Perhaps the Fed has up its sleeve a supplementary way of tightening, in the form of unwinding quantitative easing. QE purchases of bonds ended in October 2014, but since then the bond holdings have been rolled over, leaving the balance sheet position unchanged. Yellen has said ‘we expect to maintain this policy until normalization of the level of the federal funds rate is well under way’, which suggests this process will be well underway by the end of 2019, when the Fed funds rate is expected to be ‘normal’. Just as running up these bond-holdings through QE was seen as making policy more accommodating by lowering the long end of the yield curve, running them down should push up bond yields, tightening policy. It is worth noting, as well, that markets have taken bond yields up significantly over the past six months, even without any Fed action. But unwinding QE has, if anything, even more potential to alarm financial markets than an interest-rate increase, and requires a time-consuming, softening-up process by the Fed, assuring markets that this can be done smoothly.

Of course what the Fed will actually do will depend on the evolving path of the economy, but even here there are potential trip-hazards. Perhaps the main one is the composition of the Fed Board. There are already three vacancies and Janet Yellen’s term as Chair is up for consideration early next year. If the president’s business mates are more heavily represented on the future board, Yellen’s gradualism might be reinforced. If the president goes ahead with a deficit-inducing tax cut, the Fed may be reluctant to respond unsubtly with a speedy rate response, even if this might be good policy.

Yellen is conscious of how hard it is to raise interest rates (the perennial problem of monetary policy). She is well aware that it would require eight more quarter-point increases to get back to normal, each one requiring a consensus on a board which may soon be far more optimistic about America’s growth potential. Her gradualism has made good sense so far, but she may need to move from ‘gradual’ to putting at least three or four more under her belt before her current term ends in January, together with a strong signal of more to come.

Photo courtesy of Flickr/ctj71081