Geo-economics arrives

When former US president Barack Obama last tried to reshape Asia in 2016, he embraced the traditional language of liberal multilateralism and talked of writing the rules for the 21st century in the Trans-Pacific Partnership.

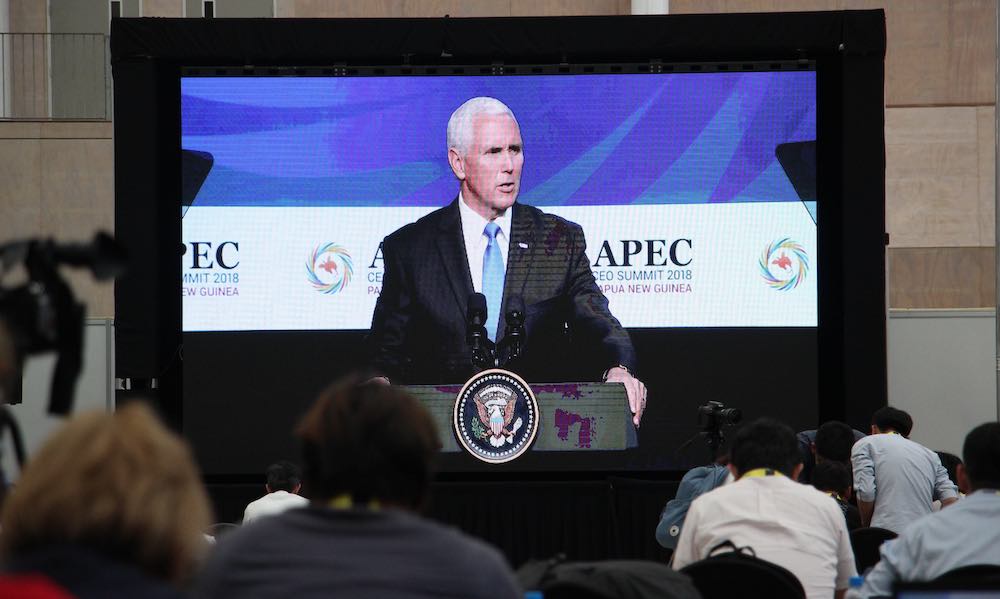

But when Vice-President Mike Pence landed in Port Moresby in November, he brought a very different toolbox: bolts for a naval base on Manus Island and cable for electrification of the highlands.

2018 was the year when the much-forecast arrival of geo-economics on the international policy landscape took very practical effect, with security considerations having much more impact on international trade and investment.

Under the old paradigm international economic policy making was built on the so-called Bretton Woods institutions such as the International Monetary Fund or rebadged World Trade Organisation, and often proceeded separately to security issues such as nuclear arms reduction.

Now new institutions such as Australia’s Critical Infrastructure Centre have brought security concerns from terrorism to the rise of China into the heart of economic policymaking.

Australia has redefined its economic diplomacy efforts into economic and commercial diplomacy but the world is shifting faster than the government wordsmiths.

Two worlds (or even more)

The most important shift from liberal globalisation to geo-economics has been the undisguised battle between the US and China to control the crowning heights of future technology from artificial intelligence to 5G telecommunications networks.

This means that whatever traditional trade negotiator’s compromise can be struck in the tit-for-tat tariff battle between the two countries, the longer-term rivalry over high tech will continue. See Stephen Grenville here.

The zeitgeist in the US and China appears to have decisively shifted towards an acceptance – and even a desire – that the world will move toward competing Chinese and US techno spheres.

While military establishments have always played a role in this sector (i.e.: internet development), traditional Bretton Woods era thinking would have seen this play out more as a battle of innovation and industrial cultures (Silicon Valley v. Alibaba).

But this year the zeitgeist in the US and China appears to have decisively shifted towards an acceptance – and even a desire – that the world will move toward competing Chinese and US techno spheres whatever the cost in economic efficiency. Other countries will be pushed towards choosing sides.

This, in itself, would be a blow to the conventional economics of globalisation but also possibly open the way to further cantonisation. For example, Minxin Pei, a US-based critic of China’s growing assertiveness, forecast during a visit to Australia in November that four or five technology standards might emerge from this competition.

Infrastructure democracy

China’s regional infrastructure building Belt and Road Initiative (BRI) marked its fifth birthday this year a bit like a kid looking down the road wondering if there is a better party getting under way elsewhere.

The cooperation which emerged between the US, Japan, Australia and others over infrastructure (i.e. on Papua New Guinea electricity) has shifted the dial towards a more competitive regional infrastructure development landscape with some more transparent standards.

Helping set better standards may well be more valuable than splashing more cash given the private funding available for the right projects in the region.

The BRI is still the biggest part of the new infrastructure Great Game, with possibly several hundred billion dollars committed towards the vague plan for spending US$1 trillion over a decade. The US by contrast is talking up a doubled development finance capacity to US$60 billion.

This week’s Australian Budget update revealed that Prime Scott Morrison’s Pacific infrastructure finance facility involves $1.5 billion for loans and $500 million in grants, with only $89 million in actual spending forecast for the three years beginning in 2019–20.

The other issue raised by Australia’s sudden shift back to building ports and power generators (or hard infrastructure) with its development aid is what happens to the previous focus on governance (or soft infrastructure) over the past couple of decades. Not only do ports and power have a hard security value but they may well be easier to sell to sceptical domestic voters. But does this mean the governance responsibility will shift more to multilateral development banks who used to be more involved in hard infrastructure.

But while the financial competition for the BRI was a notable feature of the year, the more interesting backlash has been in the region’s democracies where Chinese lending has been an election issue in places as far apart as Pakistan, the Maldives, Sri Lanka and Malaysia.

The election to watch next year will be in Indonesia, where President Joko Widodo’s new “Father of Development” image is vulnerable to how Chinese funded projects like the Bandung fast train are managed.

Trade without the deal

This new battle over global power has implication for many countries, not least Australia caught between its long-time security ally in the US and its increasingly important largest trading partner in China.

The loss of faith in Bretton Woods institution-based globalisation has had big implications for the trade negotiation process this year, with the World Trade Organisation losing further stature mid a dizzying array of regional trading arrangements from the reformatted Trans-Pacific Partnership to the new North American agreement.

Australia has found itself at the cutting edge of this post-multilateral trade deal world as it has tried to recover from the failure of its long running negotiations with India. This, even though the two countries have an interest in a stronger security relationship to deal with China.

The trade deal with Indonesia has been at least wounded by Morrison’s inept elevation of the Israeli security relationship over the financial benefits of a more formal economic relationship with Indonesia, potentially the wold’s fourth largest economy.

Former diplomat Peter Varghese has produced an India Economic Strategy for the geo-economic era by putting aside the traditional trade barrier reduction focus of such documents in favour of a more targeted Australia Inc approach.

This involves both a more interventionist government approach akin to the picking of winners that is opposed by liberal economic theory and more formal cooperation between government and business reminiscent of Singapore.

What is interesting is that the likely future Labor government wants to repeat this whole exercise for Indonesia providing a bipartisan flavour to how economic diplomacy will be played in the geo-economic era.