Chips, subsidies, security, and great power competition

Motives in the tech competition between the United States and China pose increasingly difficult policy issues for other economies.

- Government subsidies to industry in leading economies are large and growing, with potentially deep, wide-ranging, and unpredictable consequences for the world.

- It is not clear what rules, if any, will apply in this new era of industry competition, nor whether the measures will be effective in denying frontier technology to rival economies.

- The impacts of industry subsidies and export controls, including for countries such as Australia, hang on their implementation — beneficial in so far as they speed tech innovation, but detrimental if they split the global economy into competing blocs.

Executive summary

Since 2008, government subsidies to industry have sharply increased in the European Union, China, and the United States, with particularly generous subsidies directed to the semiconductor industry. Rising subsidies in the big world economies and the entanglement of national security and commercial motives pose difficult policy issues for countries such as Australia, which cannot match the subsidies provided by the great powers. US–China competition over advanced semiconductors is an awkward instance of such entanglement of national security and commerce, of subsidies and export denials. Australia needs to find its own path between adhering to US views on controlling the sale of strictly military products and technologies, while resisting the inevitable pressure from the United States to extend controls on new commercial products and technologies.

Introduction: industry policy and national security

There was a time when government spending to support particular industries was widely deplored as a wasteful interference in free markets. No longer. China, the United States, and the European Union have in recent years vastly increased government subsidies to industry, frequently supporting the development of advanced technologies important in peace and war. Subsidies are now sometimes complemented by policies designed to deny technological innovations to competitor economies.

Once dominated by business interests and economic bureaucrats, large areas of industry policy are now shifting into the realm of national security. Australia’s Director-General of the Office of National Intelligence, Andrew Shearer, noted in March 2022 that technology is “the centre of gravity in this new geopolitical contest, and we’re going to see increased manoeuvring between the great powers in particular for pre-eminence in critical technology”. [1]

For Shearer, that means “an end of compartmentalising economic engagement with China and Australia’s long-standing security ties with the United States”. The policymaking apparatus in Canberra has been rearranged in recent years to bring a national security lens to bear on what were customarily economic policy decisions. This is evident in Treasury, the Foreign Investment Review Board, the Department of Foreign Affairs and Trade, and in the enhanced importance of the Office of National Intelligence and the Department of Home Affairs, as well as in the changing focus of the Five Eyes intelligence-sharing group of which Australia is a member.

Once dominated by business interests and economic bureaucrats, large areas of industry policy are now shifting into the realm of national security.

In the United States, the same viewpoint was most clearly and forcefully represented by Matthew Pottinger, a White House national security official in the Trump administration. Pottinger argued in 2021 that US business must take “bolder steps to stem the flow of US capital into China’s so-called military-civil fusion enterprises and to frustrate Beijing’s aspiration for leadership in, and even monopoly control of, high-tech industries — starting with semiconductor manufacturing.” Foreshadowing a sequence of steps that culminated in the Biden administration’s sweeping restrictions on exporting chips to China in October 2022, Pottinger urged that “Washington should seek to eliminate any potential Chinese advantage in semiconductors” by subsidising new chip foundries in the United States and by “applying sharper restrictions on the export of US-made equipment used to manufacture semiconductors — not just for cutting-edge chips but also for those that are a couple of generations older”. [2]

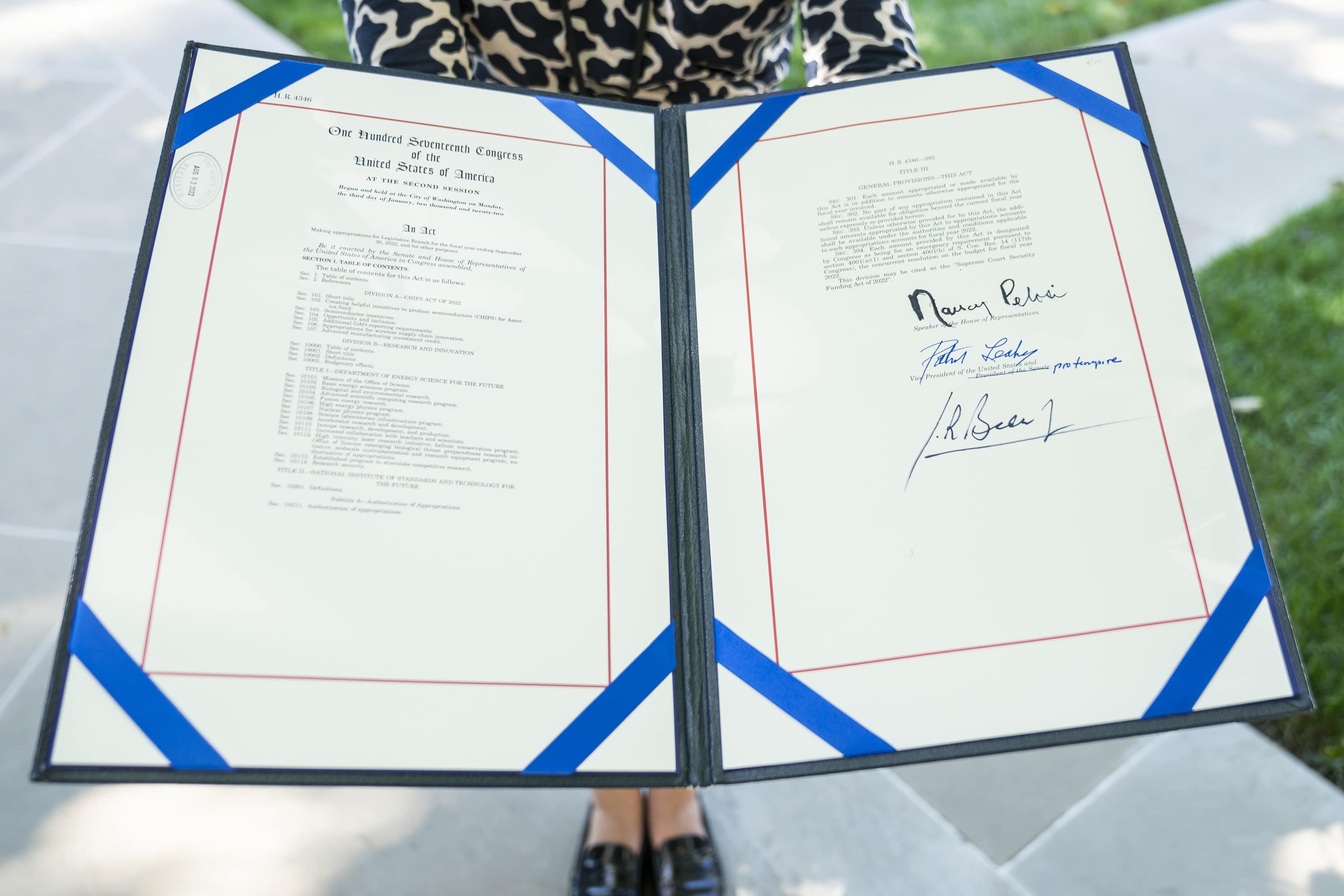

The Biden administration’s new policy towards technology competition with China includes some very significant industry policy innovations. The US$280 billion CHIPS and Science Act to support domestic technology industry in America (with US$76 billion earmarked for domestic computer chip support) is a striking example of the increased generosity of governments in the United States, China, and the European Union in subsidising industry. [3]

As developed through to March 2023, the US policy includes not only lavish government support for computer chip production in the United States, but also a ban on the sale to China of advanced chips and of machinery to make advanced chips, together with subsidy awards to US and foreign companies that agree not to initiate or expand production in China. Since the United States does not make advanced chips or the equipment to make advanced chips, its new technology policy can be implemented only with the cooperation of foreign governments and firms.

Contemporary industry subsidies and export controls thus raise new issues for global institutions and national governments. Trade policy in the half-century following the Second World War was mostly about tariff cuts, through global or regional agreements negotiated by trade officials. Contemporary trade policy is mostly about subsidies to support home production, and state interventions to entrench national control of leading technologies. Rather than supporting declining industries against cheaper imports, as tariffs tended to do, contemporary subsidies often support research, development, and production of advanced technology goods and services intended for world markets. As the trade rules monitor Global Trade Alert reported in 2021, the “negative spill overs created by American, Chinese, and European subsidies to import-competing firms pale in comparison to those created by state incentives provided by these jurisdictions to their exporters”. [4]

Much of contemporary industry policy claims a broad national security rationale for government support of what are predominantly civilian technologies and commercial industries. And while over decades, some international agreement has been reached to limit state subsidies, it is not at all clear what rules, if any, apply to this strategic competition.

Reports point to a considerable enlargement of industry subsidies since 2008, a portentous global phenomenon now deeply entangled with the wider competition between China and the United States.

There has been very little resistance to the trend of increased subsidies. China’s only concern appears to be the effectiveness of its spending. Without serious dissent, both the US Democrats and Republicans support large industry subsidies, evident in cross-floor support in Congress and the policies of both the Trump and Biden administrations. Europe, too, supports increased subsidies, while South Korea and Japan appear to be partially reverting to the industry policies characteristic of an earlier phase in their economic development. [5]

The rapid growth of industry subsidies

Though the trend towards increased national support for “strategic industries” has accelerated since the economic downturn following the 2008 global financial crisis, it was not until April 2022 that the four most important world economic organisations produced their first joint report — Subsidies, Trade, and International Cooperation — on the growing extent of industry subsidies. [6] Much of the data in this report by the World Trade Organization (WTO), the International Monetary Fund (IMF), the World Bank, and the Organization for Economic Cooperation and Development (OECD), were drawn from a large global survey of industry subsidies by a private group, Global Trade Alert (GTA), published in October 2021. More recently, the US Center for Strategic and International Studies (CSIS) has produced a report, sponsored by the US State Department, estimating industrial subsidies in China and comparing them to other major economies. [7]

Together with other work done by the IMF, OECD, and WTO over recent years, these reports point to a considerable enlargement of industry subsidies since 2008, a portentous global phenomenon now deeply entangled with the wider competition between China and the United States. [8]

Different methodologies lead to very different estimates of the level of subsidies (see Appendix for an exploration of various methodologies). Led by the WTO and building on their 2022 report, the major international organisations have now commenced an inventory of industrial subsidies worldwide, a necessary preliminary step to any comprehensive analysis of their impact or negotiation intended to constrain their growing use. [9] While tentative and incomplete, the information collected thus far is nonetheless indicative of a major realignment of industry policy as a crucial tool of competition between nations.

The GTA report, for example, suggests that since 2008, China, the United States, and the European Union have implemented more than 18 000 subsidy programs for their industries, with the number of identified programs split roughly equally between the three. [10] Together, China, the United States, and the European Union account for more than half the number of total world subsidy interventions since 2008.

By 2019, the last pre-Covid year, total annual subsidies in the three major economies had reached more than US$361 billion — an amount greater than the GDP of four-fifths of the world’s economies. [11] On some estimates, total subsidies now paid are very much higher.

Already huge, there is little doubt that these government subsidies paid to their industries by the three economic superpowers are growing. According to the international institutions, the “frequency and complexity” of “distortive subsidies” is increasing, and their “growing use” changes trade and investment flows, undermines the rationale for tariff cuts, and “undercuts public support for open trade”. It is a pattern of vastly increased spending that the IMF, World Bank, WTO, and OECD argue contributes to “global trade tensions that are harming growth and living standards”. [12]

Industry assistance through tax concessions and budgetary payments has been growing in Australia, a trend evident in many other economies. [13] In international economic competition, however, the absolute size of subsidies matters far more than relative size. European Union subsidies in 2019 were 32 times bigger than Australian subsidies, and US subsidies nine times bigger. On one published estimate, China subsidies were six times bigger, on others a far higher multiple. Against the big players, the smaller players and especially less developed economies have trouble competing. [14] As the report of the four preeminent international economic organisations concludes, the “renewed drive towards industrial policies to promote ‘strategic’ sectors” distorts international competition, especially against smaller, poorer, developing countries. [15]

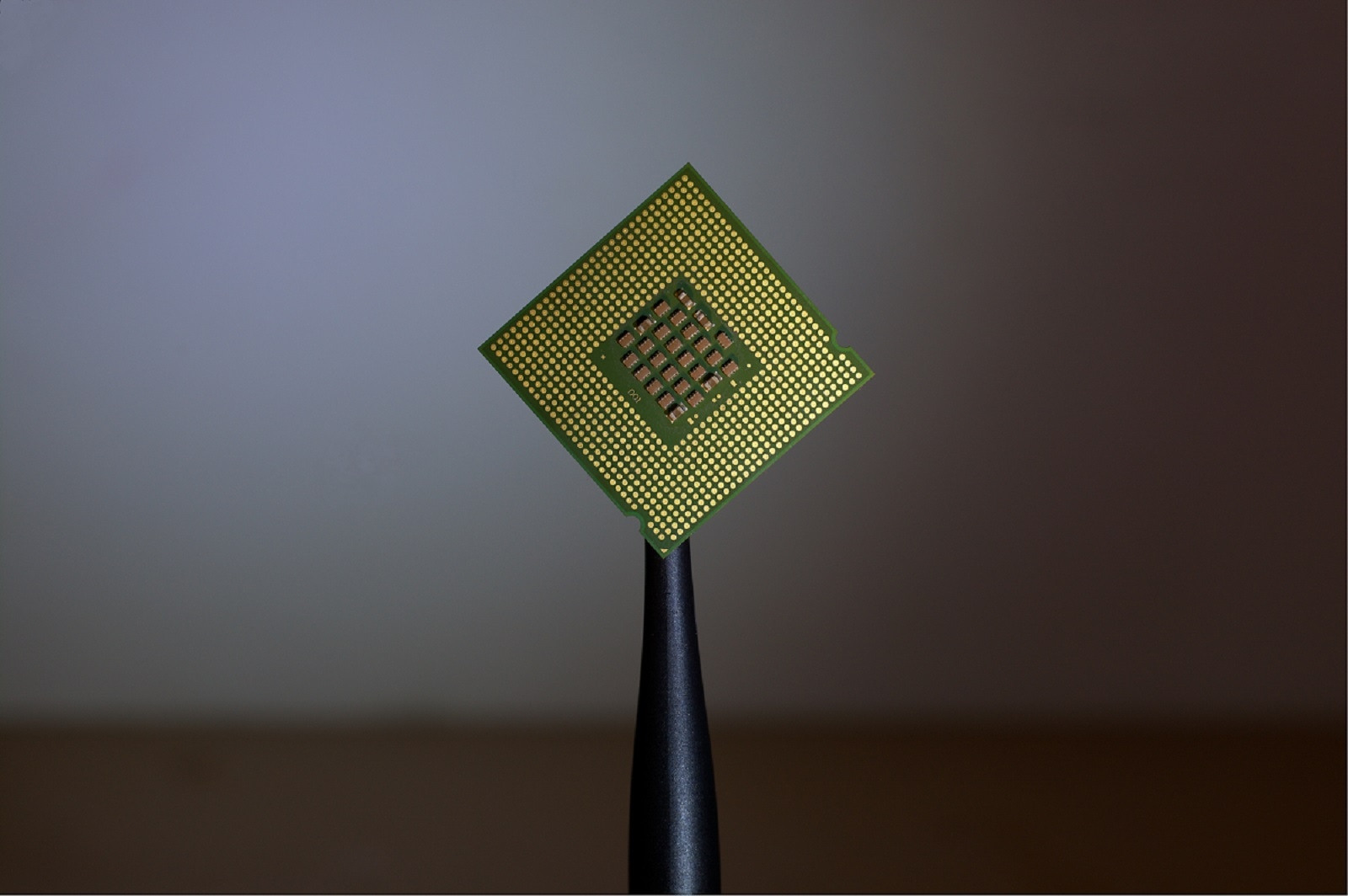

The strategic sector most prominent today is the design and production of advanced semiconductors, the tiny processors that now instruct everything from home appliances to passenger jets, and from smart phones to supercomputers.

The ability of the three economic superpowers, together accounting for more than half of global production, to out-subsidise the vast majority of the world’s other economies is one important issue posed by the vast and increasing size of global industry subsidies. There is another. The new intensity of subsidisation — evident in the enhanced rivalry among the major economic powers — reflects changing forms of strategic competition that may impose unwelcome choices on the lesser powers.

Both China and the United States have focused recent industry policy on advanced technology industries. [16] In a 2019 report, the OECD estimated total non-financial support to major aluminium producers in China at an average of US$2 billion a year over 2013–17. [17] In its more recent report on semiconductors, the data suggests major producers in China receive subsidies in the order of four times higher than those for aluminium. [18] The IMF reported that total US industry subsidies across the entire economy were US$74 billion in 2019. [19] Spending authorised under the 2022 CHIPS and Science Act alone is nearly four times bigger — and US subsidies to support green industries bigger still.

Much of the new spending is explicitly intended to gain decisive national advantage in the research and development of artificial intelligence (AI), supercomputing, big data, clean energy, biotechnology, electric vehicles, and other frontier technologies.

While past industry policies diminished international trade by supporting import-competing industry, some contemporary industry policies may increase international trade by subsidising exports. Other subsidies may speed transition towards cleaner energy by encouraging electric vehicle development, wind farms, or solar installations. The US Congress, for example, has authorised US$369 billion largely to subsidise green energy measures. While the impact of traditional subsidies on trade is the subject of agreed disciplines overseen by the WTO, the new subsidies are often not. Nor is the case for restricting them quite so clear.

Nor, indeed, is the value of these policies yet clear. Despite very large subsidies, China has yet to match the United States in the design of semiconductors, or Taiwan and South Korea in the production of advanced semiconductors, or the Netherlands in the production of machines to manufacture semiconductors. By contrast, its solar panel manufacturing industry has been an outstanding global success despite the government choosing not to intervene. [20] The US semiconductor industry, now to be subsidised, relied at first on military and other government support but its commanding world lead was built by mostly unsubsidised private business.

The strategic sector most prominent today is the design and production of advanced semiconductors, the tiny processors that now instruct everything from home appliances to passenger jets, and from smart phones to supercomputers. In that sector, the competition is most intense between China and the United States, though that competition has a number of unusual characteristics. It is also a theatre of competition that is by far the most expensive to the subsidising nations.

The remainder of this paper examines this most salient, costly, and fraught example of great power industry competition.

The US–China chips competition

Industry subsidies and export denials are entangled in the larger strategic competition between China and the United States. Industry policy is consequently entangled in national security policy.

The semiconductor competition between the United States and China is in several respects a new constellation of state intervention, subsidies, and responses — one that does not easily fit into existing dispute categories or rules. In China, technology industry policy in recent years has taken the form of public-private partnerships, often but not always arranged by state entities. The forms of capital support can also (and deliberately) resemble Silicon Valley private equity consortia and are similarly intended to provide a return to investors. [21] Though lavish in scale, supported and often controlled by industry policy officials, much of the capital deployed is private. It is usually difficult to estimate the extent of government subsidy involved, not least because of disagreements about defining what constitutes a subsidy. There is no doubt, however, that the subsidies are considerable.

The United States has responded to China’s declared technology ambitions with a combination of industry subsidies and export denials. [22]

The main focus of competition is now over what the industry describes as logic chips of the “7-nanometre processing node”, a term that once described the distance separating transistors and is now used more loosely to describe the most advanced chips that the United States does not want China to produce. The 7 October 2022 announcement by the Biden administration of a ban on exports to China of advanced chips cited China’s use of the chips (and supercomputing equipment, also included in the announcement) in military technologies and identification systems. As interpreted by reporters and Washington analysts, the broader purpose of the ban on advanced chip exports is to stop China’s advances in AI, a field both the United States and China believe will shape technology development. The Financial Times reported, for example, that the United States introduced “expansive chip export controls in an effort to slow China’s progress in artificial intelligence and supercomputers and make it harder for the country to manufacture advanced semiconductors”. [23]

China now produces more chips than the United States, accounting for 16 per cent of the world’s supply against 14 per cent for the United States.

A peculiarity is that, while the competition is between the United States and China, neither now manufacture these advanced chips in commercial quantities. US firms or US-based firms may design advanced chips, but by and large do not make them in the United States. Leading US manufacturer Intel does fabricate chips in the United States but they are of older design. “There’s zero leading-edge production in the US,” the head of the relevant branch in the US Department of Commerce told The Wall Street Journal. [24]

China now produces more chips than the United States, accounting for 16 per cent of the world’s supply against 14 per cent for the United States. But this does not apply to advanced chips. Both the United States and China rely on the Taiwan Semiconductor Manufacturing Company (TSMC) to produce their most advanced chips, in Taiwan. Taiwan accounts for 90 per cent of global advanced chip-making capacity, and South Korea’s Samsung for much of the remainder. Over the decades, TSMC has built up a prime position in the manufacture of leading-edge chips, the fabrication of which requires plants that may cost US$20 billion to construct, and which may be superseded every couple of years by plants that fabricate yet more advanced chips. The initial costs and economies of scale in advanced chip fabrication are so vast that it is difficult to compete against the two leading manufacturers. The United States stopped trying a couple of decades ago.

The chips sold by American technology company Nvidia that the United States now refuses to export to China, for example, are made in Taiwan. Despite vast investments, China has so far been unable to make high-end chips in commercial quantities. Chinese businesses also contract TSMC to make advanced chips.

The United States now wants to resume fabricating more chips onshore, arguing that it is dangerous to be so reliant on shipments from Taiwan and South Korea for such a fundamental product. The US$39 billion in semiconductor manufacturing subsidies allocated in the CHIPS legislation is for foundries to replace imports from Taiwan, not China. In principle, the subsidies reflect the higher cost of setting up fabrication facilities in the United States. TSMC and Samsung have been pressed to produce advanced chips in the United States and, like Japanese auto firms half a century ago, they have complied. Intel is also planning to make advanced chips in the United States.

But in another peculiarity, the new fabrication plants in the United States will not produce the most advanced chips. [25] Both TSMC and Samsung, supported by their governments, intend to keep the technology for and production of the most advanced chips in their home countries. By the time the new US foundries are built, TSMC will likely be producing more advanced chips in Taiwan than it will be in the United States. [26]

Yet another peculiarity is while it is possible to build a chip foundry in the United States, it is not possible to source in the United States (or any other single country) all the materials and processes used in fabricating chips. [27] The United States thus ends up (at considerable cost) with US-based foundries that will produce contemporary though not leading-edge chips, but not independent of inputs from outside the United States. Indeed, China is now the predominant source of some of these materials, including neon gas and tungsten. [28]

US export denial of advanced chips

Fabricating more chips in the United States is one arm of a current US industry policy. The other and far more adversarial arm is to deny China the ability to use or make advanced chips. This is not an unprecedented tactic in international trade competition, but it is rare, and rarely successful. To protect its wool industry, for example, Australia maintained a ban on the export of merino rams from 1929 through to the late 1970s. [29]

The US ambition is to arrest China’s advance in AI by denying it access to the computing power the United States, Japan, South Korea, the United Kingdom, Western Europe, Singapore, and Israel need to make their own advances in AI. Given the possible uses of AI over coming decades in commercial as well as military applications, the US ambition is very big indeed.

The rapidity of China’s advance in AI has surprised US officials. It is now at the world’s technical frontier in AI, with scientific publications in the area equivalent in number to those of the United States. According to CSIS analyst Gregory Allen, in AI, China has “essentially achieved their first five-year goal, which was reaching and matching the state of the art”. China is on track “to be the number-one publisher of some of the most highly cited AI research papers around the world” with “a lot of companies who are generating a lot of revenue and are building really impressive stuff”, and “universities who are putting out a lot of impressive research in AI”. [30]

The United States has long worked with its allies to refuse China access to the most advanced chips.

The US denial of advanced chips to China is unusual in that the United States must act through other countries because it does not produce the chips it wishes to prevent China producing or acquiring. The United States must prevent TSMC and Samsung from making advanced chips on contract for Chinese firms. It must also do what it can to prevent China making advanced chips itself.

Yet the machines necessary to fabricate advanced chips are not made in China or the United States, or in South Korea or Taiwan. They are made in the Netherlands, with most advanced chip fabrication depending on lithography machines manufactured by Dutch producer ASML. The United States must prevent ASML (or Japanese equipment makers, if they catch up to ASML) from selling advanced lithography machines to China. It is asking TSMC and ASML to lose revenue, which they are understandably reluctant to do. Since ASML machines and TSMC advanced chip fabrication incorporate some US designs and intellectual property, the United States asserts a right to refuse to allow the relevant licenses to be used to export material to China.

The Biden administration policy seeks not only to permanently stall China’s progress in chip design and manufacture, but also to gradually degrade the capability it now has.

The United States has long worked with its allies to refuse China access to the most advanced chips. This policy has now been enforced more rigorously, and potentially extended beyond the latest chip generation or two. As US President Joe Biden’s National Security Advisor Jake Sullivan framed it, the US objective is now to keep China as far behind as possible. [31]

The Biden administration policy seeks not only to permanently stall China’s progress in chip design and manufacture, but also to gradually degrade the capability it now has. As time goes by, and if it is unable to make the most advanced chips, China will fall further and further behind. The objective, it is widely agreed, is to disable China’s advance in AI. As explained by CSIS’ Allen, “The new American regulations say you cannot sell chips above a certain performance threshold to China anymore — the one that represents the current state of the art for training large AI models.” The United States, he explained, is “freezing the state of AI in the year 2022 for China. Soon, this will be very outdated technology.” At the same time, the United States is banning the export to China of equipment to make advanced chips. The United States had permitted the sale to China of semiconductor manufacturing equipment “that would allow China to advance, but with a certain technological distance. Now, there is active degradation of Chinese technological capabilities taking place.”

Allen cites the example of semiconductor manufacturing facilities in China that can currently mass produce chips at the 14-nanometre process node. “To those factories,” he says, “you now can’t even sell the old stuff anymore. And every semiconductor manufacturing facility on Earth is dependent upon US semiconductor manufacturing equipment. It´s not just a one-time dependency — you need spare parts, software updates, etc. This policy is designed to put those advanced facilities out of business … Previously we tried to slow the pace of the advance. This is the first time we’re actively trying to reverse technological progress.” [32] As a result, “slowly but surely, China’s AI research is going to become less and less relevant to the state of the art as it exists in the United States, Europe, and Japan, for example.” [33]

Will the United States succeed in stopping China’s artificial intelligence development?

As Allen says, this is a “big, big change” in US policy. But will it permanently freeze China’s semiconductor industry to 2022, or to chips less advanced than the 14-nanometre process node, as Allen predicts?

The US export ban is certainly telling on China’s capabilities to progress AI. According to a Taipei-based chip research service, China would need 30 000 of the banned Nvidia chips to commercialise a GPT model comparable to that released by OpenAI as ChatGPT. [34] Covering an AI conference in China in January 2023, the South China Morning Post reported tech executives’ views that China did not yet have in quantity chips comparable to those the United States now denies. [35]

Yet there is some evidence China will in time be able to work around the US denials. One sign is that Chinese businesses appear to have already moved well beyond 14-nanometre chips.

A Canadian tech news site reported in 2022 that the Chinese-owned Semiconductor Manufacturing International Corporation (SMIC) was producing 7-nanometre chips, and had been for a while. [36] The Wall Street Journal reported early in 2023 that “many in Washington were blindsided” when they learned that SMIC, China’s largest chip maker, was manufacturing the 7-nanometre chips, “a level of sophistication thought beyond its ability”. [37] Widely read tech industry news site Tom’s Hardware reported in September 2022 that SMIC was mass-producing at the 14-nanometre node and advancing to 7-nanometre and 5-nanometre nodes. [38]

While China’s current fabrication abilities remain unclear, there is little doubt Chinese businesses can now design very advanced chips. Chinese semiconductor companies have announced not only the successful design of 7- and 5-nanometre chips, but also a chip with equivalent functionality to the denied Nvidia chip. [39] The BR100 from Shanghai start-up Biren Technology has 77 billion transistors, and according to one tech site is designed for machine learning and comparable to the most advanced US chips designed for that purpose. [40]

To beat the US ban, China needs to produce its own machines to make advanced chips, or devise an alternative process it can assemble out of materials to which it has access.

If Chinese companies can now design advanced chips, the constraint on China portrayed by Allen becomes the US ban on advanced chip-making equipment from ASML in the Netherlands. The most advanced machines made by ASML are Extreme Ultraviolet (EUV) lithography systems. Since 2019, the Dutch government has denied ASML a license to export these machines to China. In January 2023, the United States reached agreement with both the Netherlands and Japan to deny some advanced chip manufacturing machines to China — though it is by no means clear that either Japan or the Netherlands have accepted all the controls sought by the United States. [41]

To beat the US ban, China needs to produce its own machines to make advanced chips, or devise an alternative process it can assemble out of materials to which it has access. China has plenty of chip-making equipment, importing US$150 billion of such machinery over the five years to and including 2022. [42] If it has managed to design and produce very advanced chips, advanced semiconductor manufacturing equipment is perhaps not beyond its range.

Nor is it entirely clear that China needs EUV lithography machines to make some version of advanced chips. TSMC, for example, used Deep Ultraviolet (DUV) lithography machines in the early stage of its 7-nanometre volume production. [43] ASML’s CEO Peter Wennink has confirmed that the company is still able to ship DUV machines to China. [44]

The United States began to restrict China’s access to advanced chip manufacturing machines in 2016, and the ban on ASML selling EUV machines to China has been in place since 2019. Yet Chinese businesses appear to have not only successfully designed versions of some advanced chips, but also managed to produce them.

It is also possible that there are not many more advances in the size and power of chips yet to be made. The CEO of Nvidia, for example, is sceptical that a great many more transistors can be lodged on a tiny piece of silicon. [45] In the time it takes China to catch up to the frontier of today’s chip technology, the United States, Taiwan, Japan, and South Korea may not be able to move as far forward in chip development as has been typical over the last fifty years.

ASML’s Wennink told Bloomberg in January 2023 that China will sooner or later develop its own chip-making machines. “If they cannot get those machines,” he said “they will develop them themselves. That will take time, but ultimately, they will get there.” [46] Analysts at Georgetown University’s Center for Security and Emerging Technology concede that China has the resources and the will, so catching up in semiconductor manufacturing equipment “is not impossible”. [47] The Australian Strategic Policy Institute’s Samantha Hoffman told the ABC in 2022, “While having a long way to go in its advanced chip manufacturing, China will likely close the technological gap”. [48]

National security, commercial competition, and the rest of the world

The ambition of the United States to freeze China’s progress in making chips and particularly its progress in AI depends in large part on the continuing cooperation of other countries. But while security allies may be willing to assist the United States in enforcing policies related to national security, they may not be so reliable if US motives are mostly about protecting the commercial leadership of some of its industries, or merely hindering China’s economic growth. As European Union official Thierry Breton told a Washington audience in late January 2023, “You will always find Europe by your side when it comes to ensuring our common security in technology,” but “action should be limited to what is necessary from a security point of view”. [49] Speaking in March 2023, European Commission President and former German Defence Minister Ursula von der Leyen moved closer to the US position. [50] For Brussels, as for many capitals, determining what is necessary from a security point of view is as yet unsettled.

Both China and the United States declare that technology leadership is a national security requirement. Such a declaration reinforces an argument for overriding WTO rules on subsidies and other forms of government industry support, though not one accepted by WTO members without detailed examination. [51]

The United States has claimed national security reasons for denying advanced chips and production technologies to China, and for subsidising the fabrication of chips in the United States. (Existing military demand includes some advanced chips but is mostly for less advanced chips, of a kind that China now produces in considerable quantity. The major US military chip requirement is for older chips now commercially obsolete.) [52]

There is no doubt AI has military and, more broadly, national security applications. These include facilitating cyberattacks and defending against them; improved battlefield surveillance; improved machine-guided weapons and weapons platforms such as military aviation and seacraft; and faster battlefield information collection, analysis, and response. All are now in development among the major military powers — and many lesser military powers — and have been for some time. The Turkish armed drones now deployed in Ukraine, for example, navigate using AI. [53]

The relationship between technology and the military has changed over the last few decades, at least in the United States.

There is also little doubt that the military applications of AI are a small sliver of the current and future uses of AI in commerce and economic transformation. As Washington analyst Paul Scharre points out, AI is a general-purpose enabling technology like electricity or computers. [54] It is being developed by commercial firms for commercial markets, with the military in the United States, China, and many other countries taking an interest in its possible military and national security applications.

The relationship between technology and the military has changed over the last few decades, at least in the United States. In the post-war decades, the US military and government institutions more broadly sponsored research that resulted in technologies that had military but also civilian applications. [55]

Today, the sequence has reversed, with commercial civilian technologies such as enhanced computer capabilities, advanced chips, high-speed computers, and new communications capabilities sometimes also finding military uses. Once accounting for a very large share of total research and development spending in the United States, military research and development spending now accounts for very little of the total. [56] Many contemporary technologies have some military applications, but most are developed for, paid for, and applied to commercial use.

As a result, although both sides claim national security rationales for subsidising chip technologies and the United States claims it for denying China advanced chips, the technology “war” is inevitably over products mostly commercial in their origin and purpose. As the US Semiconductor Industry Association proudly proclaims, “Global semiconductor sales are driven by products ultimately purchased by consumers.” [57]

The products are mostly used for leisure, entertainment, convenience, and health for ordinary people. The “fourth industrial revolution” for example — the much-hyped expectation that AI, immense amounts of data, and automation will revolutionise the production of goods and services while also creating new products and new markets — is primarily a story about cheaper products, speed, and convenience, all directed at household consumers. So too, the closely related “internet of things”, the market for computer games, electric self-driving vehicles, biotechnologies, and much more.

In the Trump administration, technology competition with China was, for a significant faction within the executive, the spearpoint of a wider program to slow China’s economic advance and stimulate American manufacturing. As former director for China in the National Security Council staff of the Obama administration, Ryan Hass, recounts in his 2021 book, Stronger, although the declared aim of the Trump administration trade war on China was to compel China to amend its unfair trading practices, “in the comfort of quiet conversations, US policymakers have readily acknowledged to me their underlying motivations to slow down China’s rise and reinvigorate the US manufacturing sector. They saw trade activism against China as a means of pressuring companies to shift supply chains out of China, divest from China, and reinvest in the United States.” [58]

For American allies, the question is whether and to what extent they are willing to join the United States in arresting China’s development of AI.

The United States and China are using a very broad definition of national security in their competition over advanced chips. Each wishes to be independent in this crucial product. In most world capitals, this is understood and accepted as a fact of global politics, one anyway impossible to change. The competition does not affect the legacy chips in common household, industrial, and military use, and the competition in advanced chips comes at no great cost to other countries. But the US applications of export denials that depend on the cooperation of its friends and allies pose somewhat different issues.

For American allies, the question is whether and to what extent they are willing to join the United States in arresting China’s development of AI. For Australia, this might, for example, involve terminating research partnerships with Chinese academics in the AI field.

In the October 2022 announcement, the United States asserts a right to forbid technology exports to China from other countries if those products use US technology and fall within the scope of the US controlled products lists. This may extend to, for example, Australia–China cooperation on supercomputing and other existing joint programs. According to Australia’s Department of Foreign Affairs and Trade, “Australian researchers rank 3rd for contribution to Chinese research publications, and vice versa” and “there are literally thousands of partnerships” between Australian and Chinese researchers covering a wide range of science and technology fields, including agriculture, medicine, and high-tech industries. [59]

The problems will be much more pressing if the United States moves ahead with wider export denials on technology to China, as Biden administration officials expect. As the Carnegie Endowment for International Peace reported in 2022, the new policy “is unlikely to stay contained to semiconductors. Alan Estevez, the [US] undersecretary of commerce for industry and security, recently suggested the administration is also contemplating similar controls in areas like biotechnology.” [60] Covering the speech by Estevez, The New York Times reported, “When asked if the United States would consider further controls in quantum information science, biotechnology, artificial intelligence software or advanced algorithms, Mr Estevez said that he was meeting with his staff weekly to discuss such restrictions. ‘Will we end up doing something in those areas? If I were a betting person, I would put down money on that’.” [61] The possible range of additional denials is very wide and would cover a number of areas in which Australia and China has established scientific and technical cooperation.

As Peterson Institute for International Economics president Adam Posen argued recently in Foreign Policy magazine, the “US attempts to impose arbitrary export and investment restrictions on China that extend to other countries” may well “backfire”. For such restrictions to succeed, the United States “would have to become a commercial police state on an unprecedented scale”. [62]

Can the United States control China’s technological development?

A broader issue raised by US chip denials is whether the United States and its allies can successfully control China’s technological development any more than China can control the technological development of the United States.

The technology competition between the two countries is all the more vigorous because the two contestants are so well matched. The United States is the bigger economy, with China’s output four-fifths of America’s measured in current exchange rates. It is not at all certain that China’s output will surpass that of the United States before China’s growth rate slows to America’s likely growth rate. [63] But China saves and invests more, with total investment each year 50 per cent higher than the United States. [64] China’s manufacturing output is far bigger than that of the United States. In 2021, on World Bank numbers and measured in current US dollars, the US manufacturing sector was somewhat bigger than those of Germany and Japan put together. But it was only slightly more than half the size of China’s manufacturing sector, which is comfortably bigger than the manufacturing sectors of Japan, Germany, and the United States put together. [65] Once strong only in simple products such as clothes and shoes, much of China’s manufacturing is now state of the art. In technology competition, China’s much greater manufacturing output to some extent offsets its smaller economic size overall. [66]

If lagging the United States in science, China is closer in engineering. China operates hundreds of satellites, has launched numerous space probes, and has begun building a permanently crewed space station.

Once well behind the United States and Europe in science and technology, China is rapidly catching up. Though the citation rates for Chinese research papers are lower, China and the United States now account for two-thirds of science papers published each year, split about equally between the two. [67] China’s top research institutions in science and technology are said to be lower in quality than comparable US institutions, but China produces each year many more graduates in science, technology, engineering, and mathematics than the United States. The Center for Security and Emerging Technology predicts that by 2025, China will be producing nearly twice as many doctoral graduates in STEM fields — science, technology, engineering, and mathematics — as the United States (and three times as many if non-American doctoral graduates from US universities and institutions are excluded from the US total). [68] Less than two-thirds of the US total ten years ago, research and development spending in China is now around 85 per cent of the US total — and more than three times the total of research and development spending in South Korea, Japan, and Germany combined. [69] Though still catching up in many areas, China is at the forefront of some fields, including supercomputing. Reflecting their different economic structures, China puts more emphasis on some fields, and the United States on others.

If lagging the United States in science, China is closer in engineering. China operates hundreds of satellites, has launched numerous space probes, and has begun building a permanently crewed space station. [70] In AI — a key component of the “fourth industrial revolution — China has potential strengths. AI depends on rapid calculations, so China’s strength in supercomputing is helpful. AI also depends on vast quantities of accessible data. With a population four times that of the United States, accessible data is also a strength. And as a Brookings Institution study argues, the basic scientific breakthroughs in AI have already been made. Its development is now more technology than science, and this is where China’s bigger technology workforce and its capacity to quickly mobilise funding is important. [71]

For decades, the United States has pursued a policy of denying China the most recent chips and the most advanced machinery to design chips, either from US designers and fabricators or from allies such as Taiwan, South Korea, Japan, and the European Union. [72] For decades, China has attempted to build its own capability to design and fabricate chips, often with indifferent success. The United States remains ahead in design, though as we have noted, Chinese businesses have recently made gains. [73]

In those same decades, the United States and its allies have maintained a ban on most weapons sales to China and on the sale of critical dual-use technologies. The US Department of Commerce has also not permitted the sale to China of a wide range of declared products, and restricted others. US allies are expected to adhere to the US policy, and usually do. Yet, over the decades, China has developed nuclear weapons, modern intercontinental ballistic missiles, and satellites, all despite strong US opposition.

In the military realm, US intelligence analysts expect China to continue to make technological advances. In a 2019 report on China’s military capabilities, the US Defense Intelligence Agency concluded that “In the coming years, the PLA [People’s Liberation Army] is likely to grow even more technologically advanced, with equipment comparable to that of other modern militaries. The PLA will acquire advanced fighter aircraft, naval vessels, missile systems, and space and cyberspace assets as it organises and trains to address 21st century threats farther from China’s shores.” [74]

In a world where basic science is available to anyone educated to understand it and where engineering skills are universally taught, preventing the spread of new technologies is hard. In past episodes, the United States failed in its objective of preventing China attaining capabilities that in important respects match those of the United States. If that is the case, then perhaps the global controversy over technology export bans and technology subsidies, and over the China–US technology war, is narrower and of less consequence than often proposed. Much depends on whether, as is sometimes eagerly supposed, a highly subsidised technology race is part of a wider “deglobalisation” or “onshoring” trend. So far, at least, there is little evidence of such a movement. Global trade has never been higher, and cross-border investment has recovered from the Covid downturn. Trade between the United States and China is strong, although the United States appears recently to be losing market share in China. [75]

Conclusion

The argument of this analysis is that while there has been an immense growth in industry subsidies and in associated technology competition between the great powers, its national security rationale is incidental to its commercial implications. There is, for example, no decisive superweapon in prospect (indeed, the major powers already possess one, in nuclear weapons). Though rationalised on national security grounds, its impact is primarily on commercial competition. Given the importance of the technologies in contest, such as AI, the economic consequences could be considerable.

There are agreed global rules on government subsidy for industry, but none is likely to constrain this subsidised technology competition. Subsidies contingent on export performance are banned under long-established WTO rules. Beyond that prohibition, the rules are dependent on the effect of a subsidy on the welfare of other countries. Under the Agreement on Subsidies and Countervailing Measures, countries are entitled to take the counter action of imposing higher tariffs if a trade partner pays certain kinds of subsidies to its industries. [76] To be an actionable infringement, the subsidy must be offered by a government body. The subsidy must significantly harm the trade of another country, which is then entitled to impose a duty equivalent to the subsidy. A subsidy available to all industries, even if provided by a public body, is not actionable. For example, a generally available tax concession for research and development spending is not actionable. It is difficult to fit technology subsidies into any actionable category.

The only constraints to the trend towards increased industry subsidisation by the major powers, and to the closely linked trend towards non-commercial forms of competition in advanced technology, are commercial reality and budgetary imperatives.

From the point of view of middle powers such as Australia, some tendencies of this vastly expensive technology competition among the great powers are welcome, and some not. It depends on the form the competition takes. While a problem for taxpayers in Europe, the United States, and China, it is no problem for Australia and countries like it if great powers spend a lot on supporting advanced technologies. The rest of the world benefits from the products of the new technologies and may also be able to acquire the technologies for use in their own products.

The competitors are well matched, and a vigorous competition is more likely to produce favourable outcomes for the rest of the world than the domination of a technological field by one country.

Yet the widely expanded scope of product denials imposed by the United States on China poses new issues for third countries such as Australia. The interests of Australia and smaller economies like it lie in encouraging free commerce in technology and in discouraging tendencies to split the global economy into contending and restrictive technology domains. It has its proponents in the national security world, but a sharply divided global economy would be the least productive, the most unstable, and the most alien to the freedom of global commerce on which the prosperity of Australia and countries like it has been built.

Furthermore, the competitors are well matched, and a vigorous competition is more likely to produce favourable outcomes for the rest of the world than the domination of a technological field by one country. Lavish support for advanced technology also promises more rapid innovation and faster increases in productivity and living standards globally — even if it comes at what may be considerable expense to major economies.

But the benefits of enhanced technology competition for the rest of the world can only be realised if the products of the new technologies are freely traded. If they are inaccessible to the rest of the world, the country possessing the monopoly may be able to advance its industries at the expense of other countries’ industries.

This is true also if the products of new technologies and the technologies themselves are available only to some countries and not others. If Australia is able to acquire advanced products from the United States only at the cost of denying itself advanced products from China, its choices are restricted. It would also be participating in the creation of competing economic blocs that discourage trade and investment between them.

Australia needs to find its own path between adhering to US views on controlling the sale of strictly military products and technologies, while resisting the inevitable US pressure to extend controls on new commercial products and technologies. To the extent that export controls and subsidies are leading to a world economy where markets are segregated into separated zones, Australia’s long-term prosperity is at risk. As Ryan Hass writes in Stronger, the United States should adapt to China’s rise to something near equivalence. The two great powers are locked in a “competitive interdependence” from which there is no exit, except through a cataclysm. [77]

Acknowledgements

Thanks to three anonymous external reviewers and to Lowy Institute colleagues Roland Rajah, Hervé Lemahieu, and Sam Roggeveen for helpful comments on earlier drafts, to Hervé, Sam, and Anthony Bubalo for managing and editing the paper, and — as ever — to Clare Caldwell for her patient support and a painstaking final edit.

Appendix

Measuring the extent of industry subsidies: what do we know?

As the IMF, WTO, OECD, and World Bank have pointed out, it is difficult to present credible policies to constrain subsidies unless we know how big they are, and where they are applied. The overall level of subsidisation in the global economy is difficult to estimate, and so is the presence of subsidies in some industries and not others. The task is complicated by the different structures of economies, and particularly the United States compared to China.

The Global Trade Alert (GTA) survey of industry subsidies was released on 25 October 2021. [78] Its estimate of 18 137 corporate subsidy schemes and awards implemented in China, the United States, and Europe between November 2008 and October 2021 is, the authors report, probably an underestimate. [79] The top three trading economies — China, the United States, and the European Union — together accounted for more than half of the total number of global subsidies. [80] The European Union and China implemented roughly the same number of industry subsidy programs, with the United States implementing slightly fewer.

Challenging the notion that industrial subsidies are unique to China, the GTA reported that “Since the European Union and the United States were together responsible for 12 629 entries in our inventory of corporate subsidies, claims that extensive resort to subsidies is found only in state dominated economic development models should be discounted. Resort to extensive subsidisation is also a common feature of policy in more market-based systems of economic governance.” [81]

The report calculated a cost of subsidies for China but not for the United States or the European Union. [82] It estimates that subsidies paid by Chinese governments increased from US$6.5 billion in 2009 to US$29 billion in 2020, with the total split roughly equally between private and state-owned enterprises. [83] Separately, GTA quotes IMF estimates that government subsidy payments to companies in the European Union totalled US$262 billion in 2019, and in the United States US$74 billion. [84]

On these numbers, the level of subsidisation in the United States was in 2019 two-and-a-half times that in China, and in the European Union nine times the level of industry subsidisation in China. [85]

In its 2022 report, by contrast, CSIS estimates Chinese subsidies in 2019 at US$248 billion, more than eight times the GTA estimate. It is considerably more than the CSIS number for the United States or any other national economy, though below the IMF estimate for the European Union. [86] The difference between the two estimates for China arises because CSIS includes a lot more elements in its definition of subsidies.

The GTA estimate is based on subsidies reported by listed businesses in China, whether privately or publicly owned. Chinese-listed businesses are required to report government subsidies, and do. The GTA report confines itself to what is available in these reports.

The CSIS report is an estimate of subsidies that goes well beyond those reported by listed companies in China. CSIS estimate begins with the disclosed government subsidies to listed businesses and builds on it. For listed businesses in 2019, CSIS finds the total reported government subsidies were US$41 billion. It assumes that unlisted state-owned enterprises (SOEs) are subsidised to the same extent as listed SOEs, when scaled by revenue. [87] That brings the total up by US$20 billion (or a total so far of US$53.8 billion by moving research and development subsidies to another column).

Listed businesses also disclose all tax concessions and refunds received from government. CSIS assumes these are all subsidies and adds them to the total. As with reported subsidies, it assumes that all unlisted SOEs are given equivalent tax concessions and refunds when scaled by business revenue. These elements together add US$54.7 billion to the total.

The CSIS report then comes to the biggest addition — concessional lending. CSIS argues, as does the OECD, that China’s SOEs can borrow for less than private businesses because of a market belief in government backing for SOEs’ debts. It assumes that because of this market belief, SOEs borrow from banks at half a percentage point less than private business, and from bond markets at 1.4 percentage points less. CSIS takes half a percentage point of all SOE borrowing and 1.4 percentage points of all SOE bond issuance and adds that to the subsidy total. That adds US$73.6 billion to the total.

There are a couple of other contributions to the “stack” of subsidies. SOEs have outstanding net invoices to pay. CSIS argues that these outstandings reflect the favoured position of SOEs, which are able to pay bills slowly but demand their own invoices be paid promptly. CSIS says this is equivalent to a bank borrowing. It applies a bank lending rate to the net outstandings and adds that to the total of subsidies.

With a few other assumed subsidies, CSIS gets to its total of US$247.7 billion in Chinese government subsidies to industry in 2019. CSIS does not disguise the fact that its procedure is based on a series of assumptions rather than actual data. Some of these assumptions seem to me to require a bit more evidence or a more robust rationale.

For example, are all the reported tax concessions and refunds subsidies? Like the economies of the European Union, the United Kingdom, Australia, and many other countries — but not the United States — China imposes significant consumption taxes. In China, the standard rate is 13 per cent. Since they are domestic consumption taxes, the tax paid by corporations is refunded to exporters on the product exported. The United States regards these refunds as export subsidies, a position not accepted by the rest of the world. It is not clear in the report whether reported refunds includes this element.

Many corporations in the United States and Australia pay less than the nominal corporate profits tax rate, one of the reasons the United States and Europe attempted to negotiate a corporate minimum tax. There are plenty of deductions available, some of them industry-specific. Are US subsidies equivalently estimated?

Are unlisted SOEs paid subsidies equivalent to listed SOEs when scaled by business revenue? I don’t know, and CSIS does not know.

China’s SOEs do indeed borrow at a lower rate than privately owned businesses and are able to issue bonds at a lower rate not only in China but on world capital markets. This reflects some belief on the part of lenders that the debt is guaranteed by government. If SOEs get better lending rates because their debt is believed to be backed by government, is this a subsidy? It is not after all a “below market” rate, since for US$ bonds it is the rate paid in global markets. It is not or does not need to be directed by the state since a commercial lender would make the same decision without government direction. In the United States for example, government-backed businesses such as banks and the big government-owned mortgage lenders are able to borrow at lower rates than businesses without actual or implied government support. Chinese state-owned businesses owned by the central government have a wider credit spread to privately owned businesses than state-owned businesses owned by provincial government, further evidence that that differences depend on market pricing of risk.

This suggests that the lower interest rate paid by SOEs is a market rate for a security or a bank credit widely believed to be backed by government. Banks in the United States, Australia, and Europe borrow on the same terms. The market belief that their obligations are backed by government was confirmed in 2008, when governments announced guarantees. Government-owned corporations in the United States, such as the giant home lending institutions, have similarly discounted access to funds markets. The discount to the interest rate offered to private businesses might be regarded as a reflection of the greater role of the state and of state-owned businesses in China, an issue larger than subsidies.

Complicating the issue, although the rates assumed to be paid by China’s SOEs are lower than the rate paid by privately owned enterprises in China, interest rates are usually higher in China than the United States and have been for more than 30 years. [88] China’s SOEs pay less for finance than China’s privately owned enterprises usually do, but more than US corporations usually do.

And then there are the net payables balances. Are the net payables balances of China’s SOEs remarkably different to the net payables balances of big businesses, whether publicly or privately owned and whether Chinese or American?

CSIS does a good job of making its assumptions clear, and in pointing out the ways in which subsidies might be higher than the total of listed corporations disclosures. It asks good questions. But its results mainly arise from hypotheses and assumptions, not actual data, and some of the assumptions seem to me highly debatable.

Another approach is to look at China subsidies for the specific industry now at the heart of the competition between China and the United States — the design and manufacture of semiconductors or chips. This is not only a strategic industry for both, but also now a heavily subsidised industry for both.

In a 2019 report, the OECD looked specifically at the semiconductor value chain. [89] Unsurprisingly, it found that “government involvement (ownership or investment by the state in semiconductor firms) to be especially large in one jurisdiction” — that is, China. This and the creation of a national semiconductor fund suggest “non-market forces to be considerably stronger in China than in the other economies studied”.

It also found, however, that government support for the semiconductor industry was universal. For the sample of 21 large semiconductor firms studied, it found “total government support to have exceeded US$50 billion over the period 2014–18”. This includes support provided through “government budgets (e.g. R&D, precompetitive and competitive grants and tax concessions), and also that provided by state enterprises through the financial system in the form of below-market borrowings and below-market equity.”

The OECD found China’s support for the semiconductor industry substantial. It reported that “support through below-market equity appears to be particularly large in the context of the semiconductor industry and concentrated in one jurisdiction. Such support amounted to US$5–15 billion for just six government-invested firms in the sample, four of which are from China.”

Almost all government subsidies attributed to the semiconductor industry in China (or to the identified large corporations) were through either below-market equity or below-market lending. The OECD report does not put a number on total China government support. Supposing that it is US$15 billion to each of four China semiconductor firms or US$60 billion all up over five years, that would come in at an average of US$12 billion a year total for the biggest firms in the highest priority industry for government support. That is a very big number but less than five per cent of the CSIS calculation of all China subsidies to all industries. It is more consistent with the US$60 billion total found by GTA. Depending on the period over which it is spent, it might be somewhat more or somewhat less than the US$52 billion provided for semiconductor industry support in the recent US bill, but of the same order of magnitude. On subsidies for advanced technology industries, the United States has caught up.