Two West African nations report that Australia – and not France, the United States or China – is their largest foreign investor. Large Australia-linked energy and minerals projects will transform economies in two other nations in West Africa.

Australia’s economic linkages with Africa are growing, in goods and services trade, two-way investment and people-to-people relationships. The potential upside is high. Resource-rich African nations are key to global minerals and energy security. They also have a strong role to play in delivering on Australia’s recent commitments on assuring critical minerals supply chains both from home and other countries.

Yet Africa barely rates a mention in Australian media, nor gains much serious attention from government. Australian economic diplomacy with Africa is dimming, with just one trade commissioner left to serve the vast continent. Other policy levers have also been eroded, with development assistance slashed.

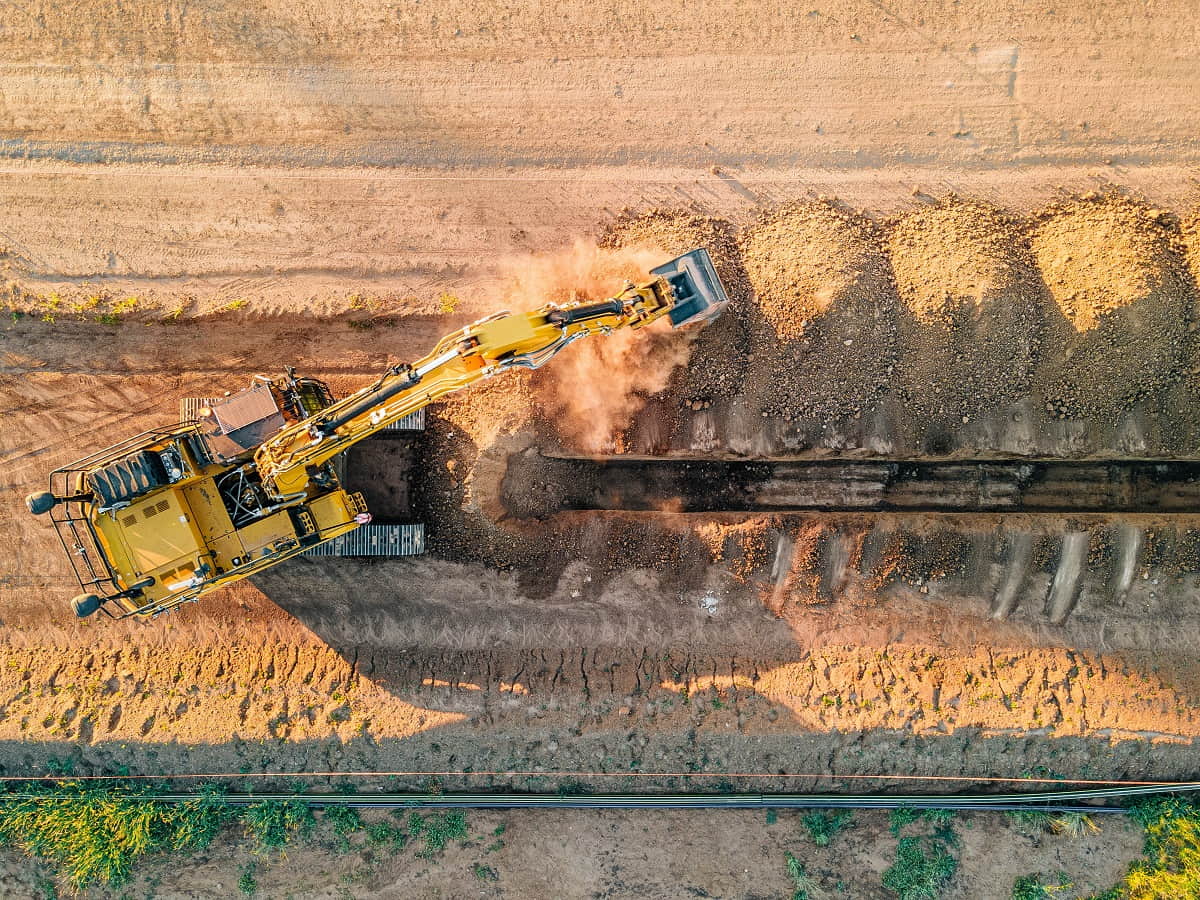

Mining is Australia’s fastest-growing category of investment in Africa, but Australia had only anecdotal evidence of this trend for 16 years from 2002-03 when ABS and DFAT last collected by-industry data on investment abroad before doing a new study in 2018-19. By then, there were 138 affiliates of Australian mining companies operating across Africa. While the wider DFAT by-industry investment data is now five years out of date, such information expands understanding of Australia’s African investment footprint. In 2018-19, a total of 318 Australian-affiliated companies across all sectors in Africa employed 19,000 people and generated sales of $8.4 billion – $7 billion worth of goods and $1.4 billion of services.

According to 2023 data from S&P Global Market Intelligence, Australian-headquartered or ASX-listed minerals companies have invested capital of $60 billion (dollars of the day) in 234 exploration, mining and processing projects in Africa. The value of their defined mineral reserves is a massive $17 trillion. Australian companies budgeted $539 million for mineral exploration in 2023, a 14 per cent increase on 2022, and 29 per cent of total exploration spending in Africa last year.

Austrade reports that 90 per cent of new exploration licences being offered by critical minerals hotspot, Tanzania, in the last two years have been taken up by Australian companies. Austrade notes that there is goodwill towards Australia and its miners in the region.

After mining, the next largest sector is financial and insurance services. Australian-based mining equipment, technology and services (METS) companies are also active in Africa, with 40 per cent exporting to Africa and one-third having offices there.

Such is the interest in Africa from Australian mining and METS companies that they have their own industry body, the Australia–Africa Minerals and Energy Group, which co-sponsors the Africa Down Under mining conference, the centrepiece of Africa Week held in Perth each year.

The African diaspora in Australia, a key vector for trade and investment, has grown markedly. In the 20 years between 2002 and 2022, the Australian population born in Africa grew by 147 per cent – more than double the growth rate from total overseas sources of migration – to reach 1.6 per cent of the Australian population.

In the ten years to 2019 (pre-pandemic), short-term visits to Africa by Australian residents grew by 70 per cent to 177,000. This is an indicator both of the increase in the African diaspora and the growing business relationship. An average of eight per cent of Australian residents travelling overseas do so for business.

Austrade cites the presence of numerous Australian university alumni in government and business in East Africa as a comparative advantage for Australians doing business in the region. This is testament to the economic benefit for Australia of the long-running but now reduced Australia Awards scholarships, fellowships and short courses available to students and professionals from 26 nations across Africa. It is also a reminder of the economic benefits of long-term investments in people-to-people relationships.

While Austrade has just three African offices serviced by one trade commissioner, Canada’s trade offices have grown to 17, each with several senior staff. Canada is developing an economic cooperation strategy with Africa as part of its export diversification strategy, and is also implementing its new Indo-Pacific Strategy in Australia’s backyard.

Meanwhile, Australian development cooperation with African countries has shrunk from $214 million of direct aid in 2012-13 to just $15 million in 2023-24. Canada’s development assistance budget for Africa is $27 million.

The Australian Centre for International Agricultural Research, funded separately to the DFAT-administered aid program, operates projects in 11 countries in eastern and southern Africa aimed at improving agricultural productivity and food security.

Despite the fall in aid to Africa, the Australian government has supported several bespoke mining governance capacity-building initiatives in recent years, including in 2023 the West African mining security conference in response to the security situation in several countries, and a minerals-focused Australia Awards short course for participants from multiple African countries. The largely privately funded West Africa Exploration Initiative is in its 18th year, transforming geological understanding and regional capacity across eight nations.

In 2016, the government’s newly established Advisory Group on Australian African Relations released its Strategy for Australia’s Engagement with Africa. The strategy proposed “a renewed vision” with six interlinked strategic focus areas for delivery of initiatives to strengthen ties. DFAT responded positively, if with equivocal commitments. There appears to be little if any progress in implementing the strategy, however, and nothing more has been heard publicly from the advisory group. Its recommendations, including expanding trade and investment, security cooperation, and environmental protection, remain current, with implementation of several even more pressing.

Meantime, Australian companies in Africa simply get on with it, while looking a little jealously at the support their Canadian counterparts receive.

And the two West African nations where Australia leads foreign investment? Burkina Faso and Mali, where Australian mining companies collectively are the largest private sector investors. And Woodside and Rio Tinto projects in Senegal and Guinea will be nation-building for those two West African countries.