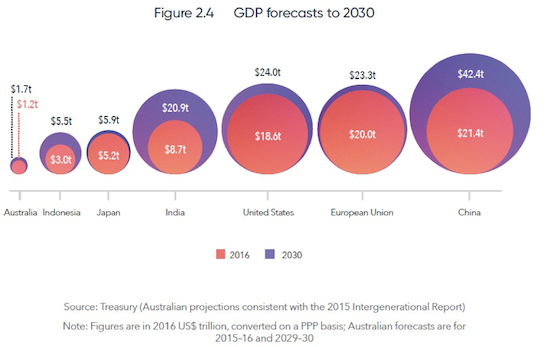

In the new Foreign Affairs White paper, the graph that seems to have attracted most attention is this one:

The message: China’s GDP has already comfortably overtaken America’s, and in just over twenty years will be nearly twice the size. Other interesting comparisons are India (growing faster than China, and nearly as big as America by 2030). Indonesia will be nearly as big as Japan. And Australia looks pretty small.

But before we make too much of this, read the footnote on page 24:

In this White Paper, economic calculations are based on purchasing power parity (see glossary). Using market exchange rates, the US economy accounted for 65.4 per cent of the global economy in 1950 and 24.7 per cent in 2016. Over a similar timeframe, China accounted for 4.5 per cent of the global economy in 1952 and 14.9 per cent in 2016.

So is China’s GDP a lot smaller than America after all? As is often the case in economics, the answer is: ‘it depends’.

If we want to compare the size of different economies or add up different countries’ growth rates, we have to get the GDP figures into a common currency. The easy way is to use the market exchange rate as quoted on the news each night. But exchange rates reflect the supply/demand balance for exports, imports and capital flows. They don’t reflect the larger part of an economy which is not traded internationally.

Exchange rates are also quite volatile, reflecting swings of confidence, ephemeral news and market sentiment. Growth rates calculated using market exchange rates would be much more volatile than underlying GDP production. They would also misstate relative size of GDP, because prices tend to be much cheaper in developing and emerging economies. This is especially true of services such as haircuts or taxis (largely because the cost of labour is so much cheaper). A US dollar, exchanged for renminbi, buys a lot more in China than it does in America. Thus using market exchange rates to compare countries would understate what you can buy, and the size of GDP, in emerging economies such as China.

Using purchasing power parity (PPP) exchange rates attempts to address this problem. The usual way of explaining is by reference to the well-known Big-Mac index from The Economist. What would the dollar/renminbi exchange rate have to be in order to equalise the price of a Big Mac hamburger in America and in China? That’s easy: divide the renminbi price in China by the US dollar price in America. The Big Mac PPP exchange rate is around 3.6 renminbi per dollar, compared with the current market exchange rate of around 6.6 renminbi per dollar.

If GDP in the two countries comprised only Big Macs (and the hamburger was identical in both countries), using this PPP exchange rate to compare the two GDPs would give exactly the right answer. It would give an accurate measure of China’s total production against America’s, and over time would correctly reflect real growth rates (how many more Big Macs were produced) in the two countries.

In practice, of course, the two countries produce quite a different mix of goods and services. If the statistician tried to compare the price of a representative basket of American production with a representative basket of Chinese production, it would be comparison of beef and bread in America compared with rice and noodles in China. As well, how to allow for subtle (and not so subtle) quality differences? A train ticket in America will provide a different experience from one in China. Are the services provided by a doctor or a public servant the same in both countries? Where labour is cheap, lot more services (such as home-help) will be in the basket. The statistician has to wrestle with these problems, and the process is not tidy. There is inevitably a serious compromise between comparability (are they the same goods?) and representativeness (do they reflect the actual output of the individual country?).

Is there a big difference between comparisons based on market exchange rate and PPP? The answer is in the White Paper footnote above. Yes, the differences are big, and they are bigger between countries at different stages of development, such as China and America. American GDP is currently two-thirds bigger than China by market exchange rate but smaller on PPP-basis. This dramatic difference is typical: for developing and emerging economies, the difference between the market exchange rate and the PPP rate is a factor of between two and four.

Which method is used also makes a lot of difference to growth rates: the IMF’s World Economic Outlook is largely PPP-based, but market-exchange-rate growth rates are also shown (see WEO Table 1.1). This version of global growth is consistently much lower than the PPP figures show, because fast-growing countries such as China and India have a smaller weight in the market-exchange-rate growth calculations.

If you want to compare trade volumes or capital flows between countries, you should use market exchange rates. For most other purposes, PPP is better. But PPP comparisons come with many caveats and provisos. To start with, the figures are only as good as the basic GDP data that go in. This leaves plenty of room for disagreement (recall all the arguments about China’s perhaps-overstated GDP). The OECD provides some guidance on when PPP should and should not be used.

If the White Paper wants to make a general point about relative economic size, this is about as good as can be done. But care is needed in drawing conclusions. If the intention is to compare economic weight, GDP (a flow of goods and services produced) needs to be supplemented by a measure of the capital stock of a country (the accumulated assets that support its capacity), including intellectual assets. China’s physical capital stock is a small fraction of America’s.

Other issues might be grounds for greater dispute, such as the heroic assumptions that go into twenty-year-plus forecasts of growth rates. For example, do demographic differences justify giving India a higher growth rate than China?

If this wasn’t enough obsession with a simple graph, there is also a vexed issue of presentation. The graph from the White Paper asks the reader to visually compare different circles in order to understand relative size of economies. Does our eye compare the height of the circles (i.e. the diameter) or the area? To help us here (and to acknowledge the problem), the Paper gives us the actual numbers as well, so we know that we should be comparing the areas. But why not use the simple, clearer presentation of a bar graph? Bureaucrats interested in the graphical presentation of data should spend some time with Edward Tufte’s masterpiece, or even take a look at this timeless piece.